Already delivered five of the six planned products laid out in our Q1 roadmap, says Crypto.com spokesperson

Crypto.com, the world’s 13th-largest digital asset exchange by total volume, has set out an ambitious roadmap for 2025, with solutions targeting both retail and institutional investors.

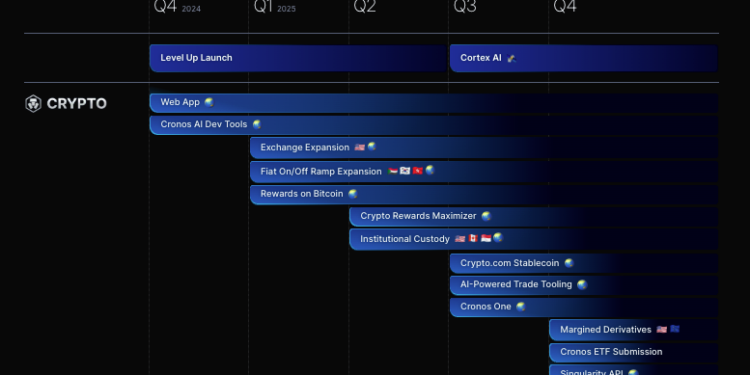

Here is an overview of what to expect from Crypto.com in 2025:

Cronos ETF

Crypto.com is planning to launch list stocks, stock options and ETFs on its platform beginning in the first quarter to eventually lead up to the launch of a Cronos ETF in quarter four.

While further details on the Cronos ETF is yet to be made public, a spokesperson said that the goal was to add to a broader effort to enhance user experience and offer a wide range of financial instruments.

ETFs provide benefits such as enhanced access to liquidity, regulatory oversight, credibility and convenience by allowing investors to own crypto without hassles of direct ownership.

The Cronos ETF in 2025 seeks to build on the wave of institutional adoption in 2024 instigated by the successful launch of Bitcoin ETFs.

The upward trajectory has continued, according to Crypto.com research, which reported that the US spot Bitcoin ETFs had total net flows of $40.5 billion on 31 January.

The weekly net inflow of spot Bitcoin ETF was around $560 million last week and the US spot Ethereum ETFs saw a weekly net outflow of $45 million last week.

Cronos One:

Another offering to look out for this year is the introduction of Cronos One in Q3, a super agent designed to help users with all their self-custodial payment and savings needs.

This is expected to deliver faster transaction throughput and lower costs on Cronos zkEVM, Cronos EVM and Cronos POS, while continuing to make the network tokenomics more sustainable.

The foundation for developing a suite of artificial intelligence (AI) development tools are already being laid with Cronos recently hosting a “Build AI-powered blockchain agent for the Cronos EVM, powered by thirdweb Nebula” webinar.

Stablecoin:

Crypto.com’s expansion plans also include the launch of a stablecoin by Q3. While details on which fiat currency its stablecoin will be offered are currently unavailable, the exchange has been aggressively pursuing licenses to operate in various parts of the world. It recently secured the MiCA license to operate in the European Economic Area.

Beyond this, the platform also seeks to launch a rewards program for BTC users on its platform and enhance its institutional custody solutions in 2025.