A sharp drop in altcoin market cap, increased volatility, and declining institutional support signal rough months ahead.

While the beginning of 2025 was initially seen as ripe for a much awaited altseason, market sentiments have proven otherwise.

A recent report published by Coinbase has warned of emerging signs of the onset of a crypto winter, as altcoins lost over 41% in market capitalization since December 2024.

Here are the highlights from the report, and a glance into how Cronos performed in the analysed period:

Numbers Draw a Sobering Picture-

The Coinbase report highlights three key figures that back its prediction of a crypto winter:

1) Loss of Value: Altcoins’ market cap fell from $1.6 trillion to $950 billion between December and Mid April. This number is 17% lower than the market cap during the same period in 2023-24. Further the drop is severe than the altcoin decline witnessed between August 2021 to April 2022.

2) Highly Volatile and Risky: The COIN50 index, tracking top 50 cryptocurrencies by market cap, has shown that the asset class as a whole has been in bearish territory since at least the end of February. This increases the risk perception for altcoins, which often spot wide price fluctuations.

3) Fall in Institutional Support:The loss in favour for altcoins by the market can also be seen in the 50 to 60% lower funding being provided by venture capitalists when compared to the crypto peak in 2021-22. Inadequate funding has a long term impact on the altcoin ecosystem, beyond current bearish or bullish trends.

What’s Triggering the Decline?

Global economic uncertainty has been deemed as the main cause. Markets have had to deal with a range of structural constraints from tight fiscal policy to tariff wars. Such uncertainty not only makes investors risk averse but also leads to stagnation in investment decision making. The potential gains from pro-crypto regulation in the US has been overridden by these pressures.

However, if macro conditions show signs of improvement, recovery for altcoins is still on the cards, said Coinbase.

How Cronos Performed:

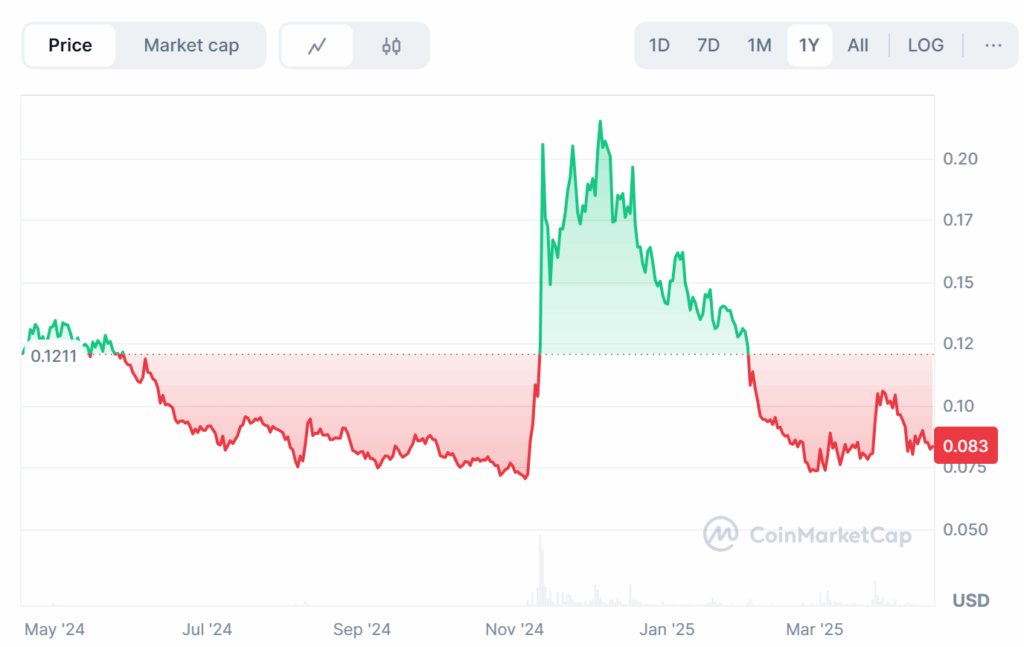

Like most altcoins, Cronos recent peak can be traced back to December 2024 when it traded at $0.21. By the beginning of the new year, CRO fell to $0.14 and eventually hit its lowest price point in 2025 by end of February – exchanging hands at $0.073.

However, unlike other altcoins that continued to face bearish sentiments in March, Cronos began its recovery. At the back of several developments in the CRO ecosystem from the 70B CRO reverse-burn to change in leadership, and Crypto.com’s increasingly valuable strategic relationship with the Trump administration, the token hit $0.10 by end of March.

However, as tariffs hit in the beginning of April, the broader market turbulence hit CRO in ways similar to that of other altcoins. CRO dropped to as low as $0.074 last week. It has since slightly stabilized and is trading at $0.083 currently. Nevertheless, as crypto winter looms, the psychological price points of $0.10 seems unlikely in the near future.

It remains to be seen how the Crypto.com and Cronos leadership respond to the altcoin downturn, considering CEO Kris Marszalek’s post on X about the delay of the altseason and identifying the right project had previously led to divided sentiments in the community.